Consumer Trends in Wine and Drinks 2025

Health, flavour, function, and transparency are driving buying decisions

The newsletter is back! After quite the absence, I know.

I’ve been on the road, speaking at events and gathering stories, which I’m now writing up.

The first event was the Vine to Mind symposium, organised by the Harvard Data Science Initiative, which I attended alongside Pauline Vicard, CEO of Areni Global.

I came away with a lot to say about AI, which I’ll put in an upcoming newsletter.

Today’s story comes from the Australian Wine Industry Technical Conference in Adelaide, where I spoke. Despite the downturn, more than 1,100 people packed the room.

Comfort is the new currency

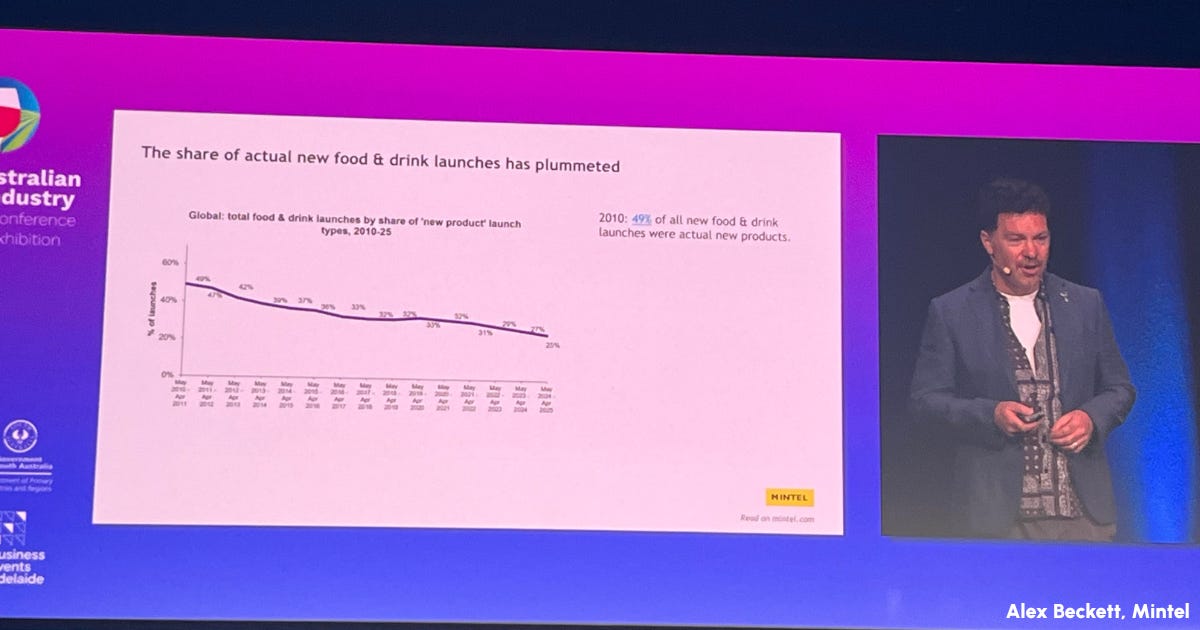

Alex Beckett, the Global Director of Food and Drink at research house Mintel, had just 20 minutes to talk about what’s driving the food and drink market, and he managed to do it without sounding like a runaway train.

Alex’s first insight— and this won’t surprise anybody — is that consumers are worried about the state of the world. Whether American, British, Australian or beyond, they’re on the hunt for solace, whether that’s Netflix or what’s in their shopping cart.

“In the UK, two-thirds of adults aged 16-to-44 tell us they’re finding more comfort from food and drink than they otherwise would,” he says. “But their expectation for food and drink is to somehow encourage their resilience.”

Ironically, his next chart showed that the food and drink sector itself is much less resilient than it once was. Since 2010, the number of new product launches has fallen by 49% as more businesses prioritise survival over innovation.

Health haloes and quick fixes

People are happy to pay extra for products that promise to improve their health.

“Everything’s now fortified, everything’s functional. There are added wellness boosts in absolutely everything,” said Alex.

“Nearly six in 10 UK adults say it’s more important to think about the nutritional benefits of food and the calorie content.”

Gen Z is the “quick fix generation — make me the best I can be”. They also want to justify their indulgences; chocolate companies are making them feel better about their choices by adding protein to their products. (Ed: ewwww.)

“The other big thing is ultra-processed food,” said Alex. “More than ever, we know that consumers are concerned about the reported negative health effects of ultra processed foods. I think in future we are going to see more brands reacting to this by being transparent about the ingredients and almost justifying the processing, because processing can be a good thing.”

Processing can offer freshness and safety benefits, “but we need to anticipate consumer suspicion about the hidden ingredients, especially around zero sugar and low alcohol.”

And he said a lot of alcohol’s competitors are talking about ingredients and “spending a lot of money on social media to educate, entertain and hold their hands about these wellness boosts.”

This has major implications for wine companies. As he said, “53% of UK wine drinkers are concerned that low- and no-alcohol wines are highly processed, putting them off drinking wine or drinking it more often.”

But Alex said consumers are happy to buy a low-alcohol wine, if the process is explained to them. He used Pewsey Vale Riesling as an example of a brand whose communication is working. Its label describes it as a “Lighter Riesling” that’s “Made in a lighter style where the grapes are harvested as the first ripe flavours develop.”

Flavour is the new frontier

“We know that US alcohol drinkers are keen to try new trending flavours that they see on social media, or which come from food trends like Dubai chocolate,” he said, with limited edition flavours “going berserk”.

Alex said that palate experimentation is a huge deal for young shoppers and that wine needs to keep up with this pace of change. “Keep an eye on these flavour trends.”

(The Australians are already on the case. Emma Brown, Head of Innovation at the Brown Family Wine Group, who was moderating, told the audience that they had launched a limited edition red wine with salted caramel. The reviews are full of customers begging them to bring it back.)

Alex said another theme right now involves “variations of sweetness,” meaning sweet and spicy, sweet and creamy, sweet and buttery. “The subtle variation of it brings the discovery.”

Escapism sells

As an antidote to the overwhelm, consumers are yearning to get away somewhere, and as they can’t, they’re buying products that have a hint of holiday in them.

“The other big trend we’re seeing in flavours at the moment is escapism — we call it ‘tourism of the taste buds’,” said Alex. “Global twists on familiar varieties.”

Inspired by shows like White Lotus, food and drinks brands are working with, for example, Thai touches, to “whisk you away to places you can’t afford to travel to.” The top tastes that alcohol drinkers are seeking are holiday flavours like lemon, pineapple and peach.

“In China, 62% of drinkers actually prefer tropical flavours in their RTD cocktails.”

Snacking has replaced dinner

Meals are giving way to snacking. “The snacking industry is absolutely soaring. Revenue growth is extraordinary — a lot of people are ditching main meals and snacking instead.”

Alex advised wine brands to think about how to pair with snacks, burgers and pizzas, “because it’s more accessible”.

He also noted that, “In the States in females 22-44, their usage of Champagne rosé and wine cocktails is absolutely flying.” What they want is, “accessible, sweet, refreshing.”

Sustainability takes a back seat

Consumers are “deprioritising sustainability” right now. Instead, they’re focusing on taste and price.

“The takeaway is that compromising on taste or price makes it so much harder for any kind of sustainably positioned food and drink product to win over consumers right now.”

Yet, paradoxically, people are “genuinely scared” about climate change and they’re actively looking for reasons to make small changes — but they want these changes to benefit themselves, as well as the planet.

One area where this tension is playing out is in packaging; there’s more interest in glass because of concerns about microplastics.

“We know that 40% of UK wine drinkers say a canned wine from their favourite brand would appeal to them,” said Alex. Among the 18-34 group, that number jumps to 61%. “Cans really work, but the benefits need to be highlighted.”

One example he gave of a brand successfully tapping into the desire for sustainability plus added benefits was Vinca, which offers organic wines in both cans and limited edition aluminium bottles, and which is flying off the shelves at Tesco. “As an added incentive, they claim that because of their canning process, they’re keeping their sulphur levels extremely low.”

And people are also thinking about the way something is farmed.

“More people are getting the importance of soil health and it’s really resonating,” said Alex, noting that McDonald’s in China has invested in regenerative agriculture, and that 55% of European adults believe that plants grown in healthy soil make for more nutritious food.

Alex Beckett’s key insights:

People want comfort and solace right now

Wellness sells, but so do quick fixes

No-alcohol wines must explain how they’re made

Sweet tropical flavours are in demand

Eco claims need to come with personal benefits

Education should be entertaining

Drinks companies need to understand that everyone is overwhelmed

The talk I wish I’d recorded

What I particularly appreciated was a presentation by Belinda Elworthy on maintaining mental health under pressure — the Australian wine community had been rocked by another untimely rural death the week before the conference, so it was both timely and practical. Unfortunately, I was on the same stage, so I couldn’t record it, but it’s well worth checking out her work.

Why wine people should care about oat milk

This week on the Drinks Insider podcast, I talked to Stuart Forsyth, the Gen X slacker-turned-global oat milk mogul behind Minor Figures. What started as a story about hipster coffee turned into a masterclass in brand-building, FMCG strategy, and scaling from kitchen experiments to international production under pressure.

If you work in wine or spirits and think oat milk isn’t your problem, think again. This is what it looks like when a challenger brand rewrites the rules. I also learned all about widget cans, KeepCup gossip, and why attitude sells better than dairy.

Plus dry humour, drywall, and the moment a joke turned into a company.

You’ll find it on Amazon, Spotify, and Apple, or anywhere you listen to podcasts. Please leave a comment and rating! It helps the algorithm.