Alcohol Looks Weaker on Surveys Than in Reality

The problem isn’t moderation but mathematics

When the Gallup poll on American attitudes to alcohol came out last month, it lobbed a grenade into the US industry.

“For the first time in Gallup’s trend, a majority of Americans, 53%, say drinking in moderation, or ‘one or two drinks a day’, is bad for one’s health,” said the report.

Mitch Louch wasn’t convinced.

Mitch Louch took to LinkedIn to express his scepticism.

Polls measure mood, not behaviour

Mitch was most recently Principal Strategist at Numerator, advising clients from Moët Hennessy to MillerCoors, after earlier stints at Anheuser-Busch and Beam Suntory.

Polls, he argues, capture noise, not behaviour — they track whatever society happens to be talking about the most at the time.

“Generally speaking, the industry is going through a transformation, and it’s not new. I’ve been watching it happen for a decade,” he tells Drinks Insider.

In his opinion, there are three things going on. The first was the pandemic.

Stimulus cash drove drinkers upmarket. “You had a $100 bottle of Don Julio 1942 flying off the shelf. I think that was a time we’re still benchmarking against, but the reality is that’s not the situation.”

While spending patterns have now normalised, inflation and premiumisation are changing how people spend, leading to lower volumes.

A third, smaller factor is substitution at the margins (THC and some non-alcoholic options), which he sees as incremental rather than category-killing.

But the biggest issue facing the market is the immovable one: demographics.

Fewer drinkers, not less drinking

The issue isn’t how people drink, it’s how many drinkers there are.

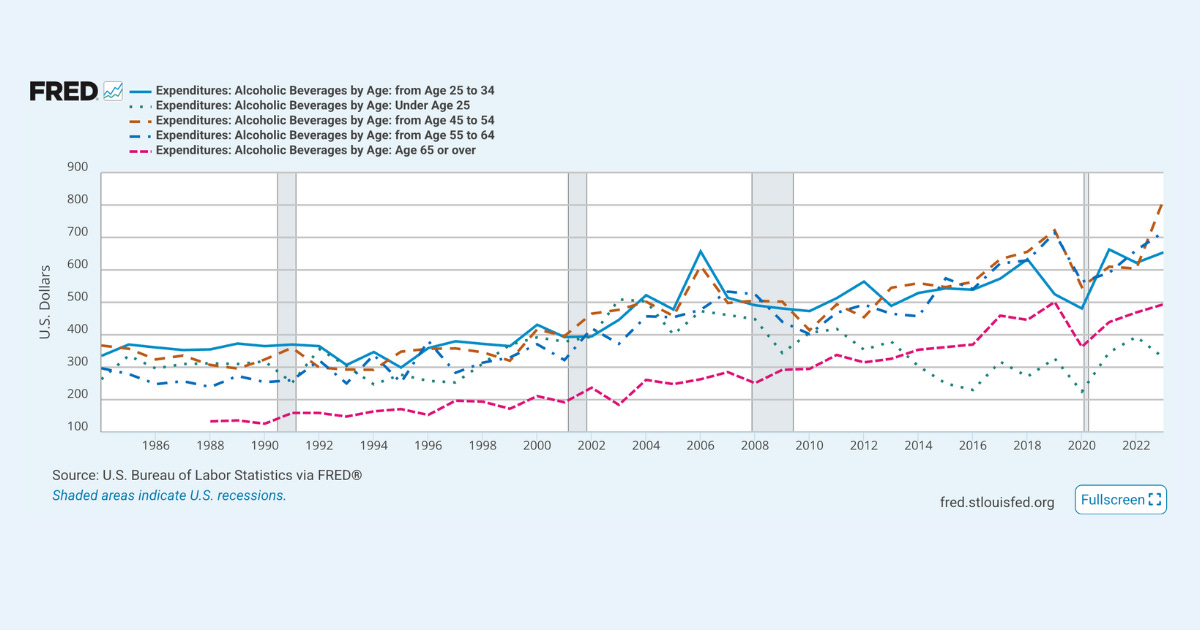

”I think there’s been too much concern on a per person basis,” says Mitch, noting that per-person consumption hasn’t materially declined.

What has fallen is the number of drinkers. The Baby Boomers are tapering off their drinking — but there are not enough Gen Xers to replace them.

“You reduce consumption as you age — it’s just something that happens,” he says. “Those are the types of things that I think are really foundational to the problem.”

As for the question of whether Gen Z is drinking less than other cohorts, Mitch thinks the anecdotal evidence is that they have more options than in the past, from cannabis to gaming. But he thinks it’s difficult to know for sure what’s happening, because on-premise data are thin — a problem with every new generation.

“What we think we know about the next 21+ generation is often hindered by a lack of consistent data in that space.”

However, the “number of restaurants continues to go up, and the number of stadiums and colleges and universities that are allowing alcohol to be sold at events has expanded exponentially.”

Which suggests there is demand. What may be changing are the venues where alcohol is being consumed.

“Anheuser-Busch and others are investing in other areas of the market because they have the most insight into what’s happening. Pickleball. Gaming,” he says. “These are all things that they recognise as the next iterations of where consumers are going to be. They’re not at a bar chugging pitchers.”

This dovetails with what Asahi Group CEO Atsushi Katsuki told the Financial Times recently, that gaming and social media are reshaping drinking occasions more than health warnings.

And demographic shifts are affecting how people are drinking all along the chain. Millennials, for example, are “at the ripe age of at-home consumption”.

So a parent with kids who can’t go out at weekends might stay at home and order in food and alcohol. “That’s where RTDs — especially spirit-based — and seltzers have really gotten a boost.”

Spirits ride the tailwind beer created

Mitch says that it was beer that taught people to pay more for less product — a change that spirits now profit from.

“Beer created its own problem by basically saying, ‘you spend $10 and I’m going to give you six beers rather than 12’,” he says. “That was really the catapult for spirits, in my opinion, especially as people aged more into spirits.”

As for wine, Mitch says there’s been a lack of innovation.

“Arguably, the last hot trend in wine was either Josh, cans or pink or bubbles. So where’s the category at? We’re not seeing innovation.”

At the same time, wine’s main problem is a ‘demographically-induced lull’. In other words, it’s a pause that demands better targeting, not panic.

Mitch thinks the opportunity for wine will come when consumers are ready to move on from spirits, which he sees as wine’s primary competitor.

“The wine industry is going to be just fine when the spirits consumer starts to say, ‘I don’t want this drink any more. I want to be able to show my refined palate. I want to do all the things that I feel about with spirits, but now I want to do it in the wine category’.”

Moderation is nothing new

When it comes to the moderation trends, Mitch says, “Ozempic is definitely a problem. You’ve got to get used to it. Wearables,” he adds. But then, he says, “my parents were on Atkins in the 90s. These things have happened every decade.”

There are always dramatic ebbs and flows within categories as well. “The 80s were all about rum, and then the 90s became this flavour variation of vodka,” he says. “And then in the early 2000s to 2010 it became whiskey and then it turned into tequila.”

He says that consumers' preferences are always shifting and what categories need to do is decide how they’re going to allow it to define themselves.

Where to find new consumers

Mitch also believes that the sector is missing out by not investing in data. He argues it’s relatively easy to pair public data with targeted consumer studies — but too few bother.

He says that it’s important to invest in those places where there are big populations of 30-40-year-olds — and that there’s enough public data out there that wine companies, for example, could easily find out which top 20 counties are over-indexing on 21-to-30- year-olds and then the 55-and-ups.

Wine companies should then “target spirits occasions. Do research on spirits consumers. I don’t need 21-to-25-year-olds. I need the ones that are actually going to drive 60% of my volume at later stages of their life.”

This applies to retailers and wholesalers as well.

“The people who win are the ones that say, ‘I’m going to take my product off this shelf because I don’t have a consumer there and I’m going to make sure that it’s never out of stock on this shelf.”

His bluntest advice: stop chasing volume everywhere — pull products from shelves where you don’t have consumers, and never be out of stock where you do.